If the international commercial terms of your consignment say that you are responsible for any damage incurred during shipping, then you almost certainly need cargo insurance. The simple fact of the matter is that even if you do everything right, something can still go wrong and even if you’re prepared to pick up the cost of the goods themselves, you may not want to leave yourself potentially liable for any damage caused by your goods. Again, if you’ve done everything right, this shouldn’t happen, but there’s a difference between “shouldn’t” and “won’t”.

With that in mind, here are some points to keep in mind when it comes to choosing cargo insurance.

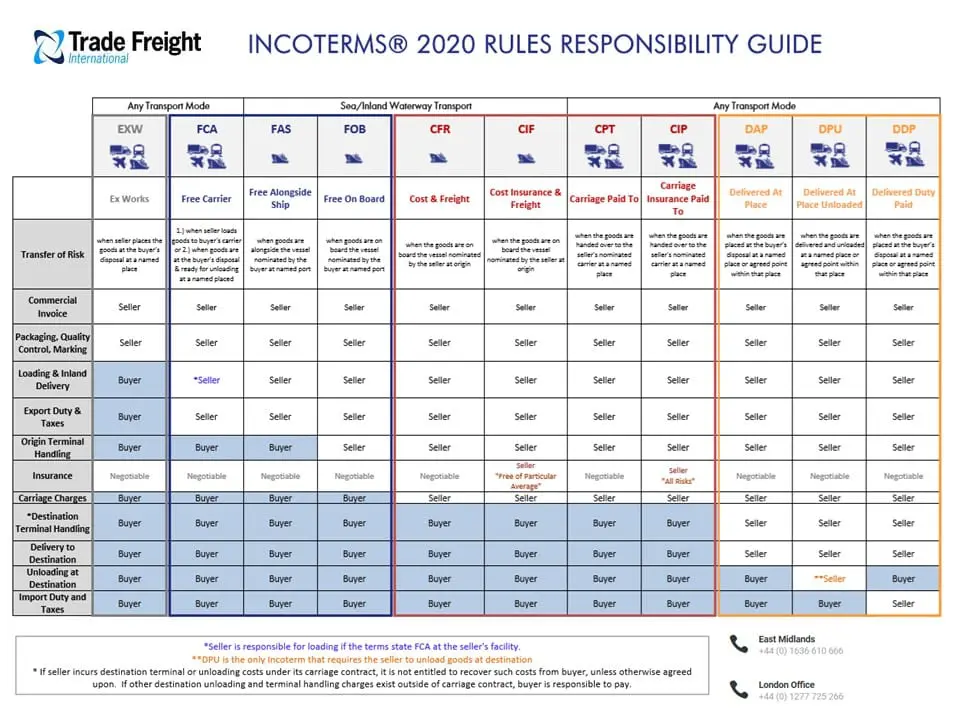

Be clear on whose job it is to choose the insurance

The sender and the receiver have to agree on whose job it is to choose (and pay for) the cargo insurance. You absolutely want to avoid situations where you are liable for the cost of anything going wrong, but the other party can pick whatever insurance they want.

It would be nice to think that they would do the right thing and make sure that they chose the appropriate cover, but sadly life doesn’t always work that way. They may just go for the cheapest option they can find because they won’t be the ones on the hook if anything goes wrong, or they may not understand what is required. Basically, if you are liable for the cost of the goods, make sure that either you are the one picking the insurance or you give clear and enforceable guidance to whoever is.

Decide whether you need an open policy or a specific policy

An open policy is valid for all shipments for an agreed period of time, usually a year. The cost of an open policy is based on the number and value of shipments a company is expected to make during the term of the policy. If a company looks like it’s going to go over this, then it can usually arrange to have its cover increased, but the onus will be on the company to do so. If, however, a company doesn’t send the expected volume or value of shipments, then it does not get the full value out of the cost of the insurance. Because of this, open policies are usually most effective when you have a predictable business model.

A specific policy is exactly what it sounds like, it is valid for one shipment and one shipment only. Specific policies can be useful in cases where you only send occasional shipments and also in cases where the nature of your shipments is varied and/or unpredictable.

Make sure you get the right level of cover

This is possibly the golden rule of any choice related to insurance and cargo insurance is no different. While you want to avoid excessive coverage (and hence paying higher fees than you need), this is likely to be far less of a potential problem than insufficient coverage. On a similar note, opting for higher deductibles may give you a lower premium but it could potentially give you more of a headache if you do need to make a claim. It’s, therefore, best to be realistic about what you could actually afford and ensure that your cover reflects this.

Last but by no means least, remember that even in the world of business, you don’t necessarily want just to go straight for the company with the lowest price, not even if you know that the level of cover is identical. Remember to look at an insurer’s reputation and their level of customer service. We can offer advice and help you to find the right insurance to keep you and your goods protected. Contact us to find out more about trade freight and shipping.

Recent Comments